A*STAR NEWS

FEATURES

Singapore SMEs Bring Robots To China's Healthcare Market

Source: The Business Times © SPH Media Limited. Permission required for reproduction.

A*STAR Partners' Centre In Suzhou Industrial Park Aims To Help Companies With Their R&d, Commercialisation And Expansion Efforts.

China’s population is both growing older and spending more on healthcare, presenting opportunities for Singapore’s small and medium-sized enterprises (SMEs) and the Agency for Science, Technology and Research (A*STAR) wants to help them seize these.

Demand is steadily growing for healthcare services and products that address age-related ailments and chronic diseases, said A*STAR Partners’ Centre (A*PC) centre director Tan Chuan Seng. This means a sizeable market for Singapore companies specialising in these areas. Furthermore, China’s government is increasing its emphasis on translating research into solutions in biomed tech, he noted. “(This) aligns well with Singapore tech companies’ strengths in biomed and biotech research and innovation.”

The A*PC, A*STAR’s first and only overseas setup, aims to help Singapore companies with their research and development (R&D), commercialisation and expansion efforts in China. It is located in Suzhou Industrial Park, which marks its 30th anniversary on Sunday (May 12). A*PC was set up in November 2020. Since then, it has helped 37 Singapore companies enter China. Since January 2021, these companies have cumulatively generated revenue of some 100 million yuan (S$18.8 million) in China, and registered close to 150 intellectual property rights there. These include some SMEs robotic healthcare solutions.

A*STAR Partners’ Centre, launched in November 2020, is A*STAR’s first and only overseas setup.

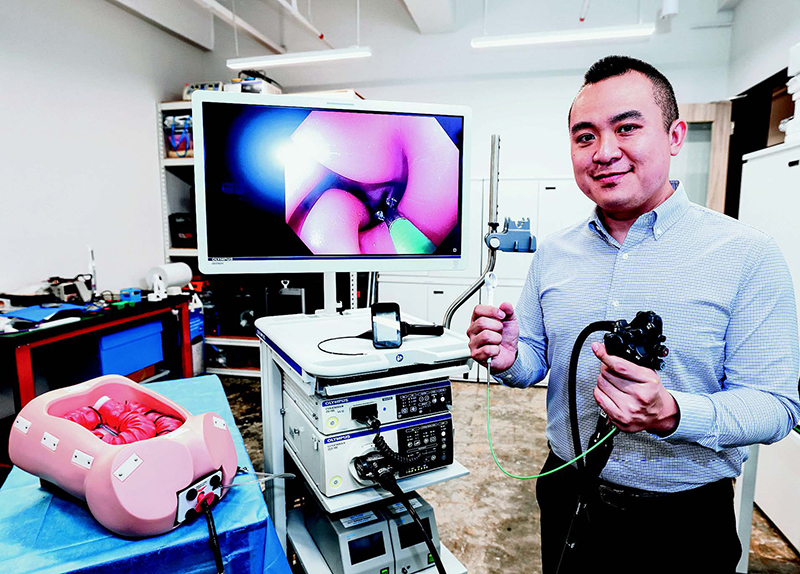

Vivo Surgical: Robotic Help For Colonoscopies

Colonoscopies are a necessary if somewhat uncomfortable procedure for screening and detecting colorectal cancer. But the procedure could also allow for complex surgery to be performed, with the aid of Vivo Surgical’s robotic attachment.

The medical device manufacturer is in the final stages of R&D for this product, which is estimated to be two years from its commercial debut. Clinical trials involving animals will be conducted in Shanghai from July, with human trials set to begin early next year. To fund these efforts, the company is conducting a Series A round, which aims to raise “an eight-figure sum” by the third quarter. Since the start of the year, Vivo Surgical has raised about half the amount targeted, said founder and chief executive officer Dr Kevin Koh. The company, which is not yet profitable, will use part of the funds to double its workforce to more than 40 in the next year, primarily for R&D.

Vivo Surgical founder and CEO Dr Kevin Koh says the company’s robotic attachment increases an endoscopist’s level of dexterity and control

From One Arm To Three

Endoscopes are thin, flexible camera systems used to examine internal organs and perform internal surgery. A common use is in colonoscopies, where doctors look at the colon’s inner wall. Vivo Surgical’s robotic attachment, built for compatibility with existing colonoscopy systems used in hospitals, could allow doctors to do more than just that. “The robot increases the level of dexterity and the level of control that the endoscopist has, from one arm to three arms,” Dr Koh said.

In a colonoscopy, doctors are looking for signs of colorectal cancer, which can include polyps lumps of tissue growth that may or may not be cancerous. To determine this, the polyps have to be extracted for further study. Conventional colonoscopy systems allow for the removal of polyps smaller than 20 mm in diameter. For larger polyps, doctors generally have to use other surgical techniques, as they are limited by the dexterity offered by existing colonoscopes, Dr Koh said. This could mean laparoscopic procedures, where small cuts are made before specialised tools are used, or open surgery, where a larger incision is made on the body.

Vivo Surgical’s robot can instead allow for larger polyps to be removed during colonoscopy, thus not requiring the body to be cut open. Said Dr Koh: “This way, you can cut the polyps out faster, more efficiently, and most importantly – it’s scarless.”

Vivo Surgical was founded in 2018 in Singapore, and licensed the robotic attachment’s underlying technology from Dr Koh’s alma mater, Imperial College London. But after a few years of R&D, the company was “confident enough” in its prototype to start talking with potential buyers in different markets. “For colorectal cancer, it became apparent that the biggest market was China,” said Dr Koh. “It was a natural fit for the robot.”

Beyond market size, China also offers ample engineering talent at a lower cost than in Singapore. It is also home to contract manufacturers that operated at a “very high level”, as they are used to working with US and European multinationals. In 2023, the company made its first foray to China, setting up an office within the A*PC. Other locations in China were also considered, but Suzhou “ticked all the boxes”, Dr Koh said. “We wanted a softer landing, (and) to go to a place where there would already be friendly parties from whom we could seek advice.”

In the A*PC, Vivo Surgical could rent office space at subsidised rates and tap A*STAR’s network of in-country contacts. These included a third-party contract research organisation that is conducting its clinical trials, regulatory officials, accountants and lawyers. Said Dr Koh: “It’s basically introductions to friendly parties that A*STAR knows, but also introductions to some of the (local) government parties.” If the company had gone into China on its own, it would have taken at least a year longer for everything to be in place, he estimated.

A*STAR also alerted Vivo Surgical to grants that it could apply for. Last August, the company bagged a two million yuan grant from A*STAR and Suzhou Industrial Park, which provided for R&D funding and access to subsidised housing for three years. Earlier this year, Vivo Surgical won another grant from the Suzhou Industrial Park Administrative Committee, which funded the lease of a 500 square metre manufacturing space and additional subsidised housing. While the company intends to outsource the bulk of its manufacturing for the Chinese market, having such a space is a regulatory requirement for any in-house works it does, Dr Koh said. Vivo Surgical uses the space primarily for offices instead.

Aitreat: Robot Massage Therapists That Do Not Tire

Co-founder of AiTreat subsidiary NovaHealth TCM Calista Lim with AiTreat's Emma robot, which relies on a sturdy metal arm and silicon "thumb" to perform TCM massages.

The creation of local medical device manufacturer AiTreat, Emma is now in its seventh iteration and has been hard at work in Singapore for several years. AiTreat hopes to bring Emma to both the US and China, too. It has partnered researchers from the US-based Mayo Clinic for clinical trials there, expected to begin later this year. If the trials go well, Emma should receive US Food and Drug Administration (FDA) approval in the next "two to three years", said AiTreat founder and CEO Albert Zhang. This will allow the company to enter the US market and the data gathered in the process can also be used to support regulatory documentation in other countries such as China, he said.

ITERATED IN SINGAPORE

Unlike in the US or China, Emma does not need to meet licensing requirements in Singapore. This has allowed AiTreat to develop updated versions of the robot in an actual clinical setting, noted Calista Lim, TCM physician and co-founder of AiTreat subsidiary NovaHealth TCM.

NovaHealth TCM has seven TCM clinics and a sports science centre in Singapore. Its first clinic in One Raffles Place was where Emma made its debut in 2017. AiTreat, which was founded in 2015, spent more than S$1 million to develop Emma. Most of the early funding came from Singapore government grants, along with startup incubator funds, said Zhang, who is also a TCM physician.

Emma has performed more than 80,000 treatment sessions within NovaHealth TCM's clinics. That the robot uses data and "hard science" to perform massages helps to draw younger patients, who might otherwise eschew TCM treatments, said Lim. China, meanwhile, is a natural destination for Emma. "In China, the TCM market is huge," Zhang said, adding that TCM chains may have thousands of stores. "So for us, the most attractive part is that if we can have several such partners, we can penetrate the market really quickly."

In 2018, AiTreat made its initial foray into China, to Chongqing. There, it built a team of more than 30 R&D staff, who worked on developing earlier iterations of Emma. But the Covid-19 pandemic put a pause to AiTreat's China plans. "China's lockdown was quite aggressive," said Zhang. "At the time, we relocated the R&D functions back to Singapore, because it wasn't possible for us to run both teams separately without travel."

By 2022, the company was ready to re-enter China, though it was still curtailed by pandemic era travel restrictions. It was only in 2023 that it reestablished an R&D presence in China – this time in the A*PC. This gave it access to subsidised office and manufacturing space, along with A*STAR's contacts, he said.

MANUFACTURING AND ASSEMBLY

In particular, A*STAR connected Ai-Treat with officials from China's National Medical Products Administration (NMPA). NMPA registration is needed before Emma can be deployed in China – a process that Zhang estimates will also take two to three years, in parallel with the FDA approval process.

Shortly after entering Suzhou, AiTreat won a 1.5 million yuan grant from A*STAR and the Suzhou Industrial Park for R&D and subsidised housing. Earlier in May, the company launched its own 200 sq m manufacturing facility in the A*PC. This required minimal capital expenditure, as the facility only carries out final assembly. "The parts are all made by different suppliers," explained Zhang. "We don't have (heavy) machinery; we just need to assemble the robots in our facility."

At its current throughput, the facility can assemble up to 200 robots each year. Each Emma robot retails for S$30,000 to S$100,000, depending on its configuration and where it is sold. Zhang declined to provide specific revenue figures, citing commercial sensitivities. "We are not profitable at the moment, because we are investing heavily in R&D."

AiTreat closed its Series A funding round in 2022, with a "few million dollars" raised. To fund further R&D, AiTreat will be embarking on its Series B round this year, hoping to raise US$10 million to US$30 million. "The Series B proceeds will be used to help us get our FDA and NMPA registrations," he added.

Was the article helpful?

A*STAR celebrates International Women's Day

From groundbreaking discoveries to cutting-edge research, our researchers are empowering the next generation of female science, technology, engineering and mathematics (STEM) leaders.

Get inspired by our #WomeninSTEM