Satisfying the Global Appetite for Sustainable Proteins

- Global concerns about food security and sustainability have spurred the demand for sustainable proteins.

- Sustainable protein sources include aquaculture as well as alternative meats such as plant protein and cultivated meat.

- Considerable developments and investments have put land-scarce Singapore at the forefront of innovations in alternative meat and aquaculture.

Scientist holding up a piece of cultivated meat in a dish

Scientist holding up a piece of cultivated meat in a dish

Why Sustainable Proteins?

Savouring a juicy steak or grilled fish may be a good source of protein in our diets. But more sustainable protein products are expected to take a bite out of the conventional meat market.

The heightened awareness of environmental sustainability and health concerns has resulted in a growing global demand for protein production methods that minimise the impact on the environment. The disruption to the global food supply chain during the initial stages of the COVID-19 pandemic has also driven many governments to push for more resilient food systems and ways to boost local production. These considerations point to sustainable proteins as one of the best options to feed the growing global population.

Moreover, innovations in biotechnology and farming technologies are making the quest for greater sustainable protein production a reality, particularly in land-scarce countries like Singapore, that do not have access to large areas of land for farming. “Innovation in sustainable proteins is of utmost importance to Singapore to meet our food security goals. This is an area which SIFBI, together with our partners, are working intently on,” said Dr Hazel Khoo, Executive Director, Singapore Institute of Food and Biotechnology Innovation (SIFBI) at A*STAR.

The alternative meat revolution

A subset of sustainable proteins that has captured the world’s attention lately is alternative meat. According to a 2019 report by Barclays, the global alternative meat market could grow 10 times to US$140 billion and capture about 10% of the US$1.4 trillion global meat industry by 2029.

Plant protein meat, or plant-based meat, is made from plants, but manufactured to appear, taste and smell like conventional meat. Innovations in the plant-based alternatives have improved tremendously over the years, and costs have become more competitive. The popularity of plant-based alternatives has skyrocketed, and the market is forecast to reach US$14.9 billion in 2027, according to ResearchAndMarkets.

“Today, plant protein meat alternatives from companies such as Impossible Meat and Eat Just are widely available,” said Mr Wang Peiyi, Deputy Director at Enterprise Intelligence Exchange, A*STAR. “This demand is expected to continue growing across the various product categories such as vegan options for milk and ice-cream.”

Cultivated meat, also known as cultured meat, also has the potential to be the next alternative protein source. Not to be confused with plant protein meat, cultivated meat is genuine animal meat that is produced by cultivating animal cells directly. The industry is seeing rapid growth. According to the Good Food Institute, the number of start-ups focused on developing cultivated meat products rose from five in 2015 to more than 70 in 2020, several of which are from Singapore.

For the uninitiated, alternative meat can taste surprisingly like real meat. This is due to the many food technologies that have been developed to improve the taste and nutritional value of alternative meat. One such technology is the 3D printing of proteins, edible packaging, flavours and additives. In September 2021, scientists in Japan successfully created a 3D-printed cut of Wagyu beef that matches the texture and appearance of traditional beef cuts.

Researchers are closer to creating more complex meat structures that resemble traditional meat in taste, texture and appearance. This has the potential impact of gaining more consumer acceptance of alternative meat,

Dr Aparna Venkatesh, Head of Agri-Food & Consumer Cluster in Enterprise Division, A*STAR

However, the alternative meat industry faces major hurdles before it can achieve greater consumer acceptance. First, some protein types such as microbial and cultured meats are still more expensive compared to conventional meats. Second, alternative meat products are labelled “heavily processed”, and consumers tend to avoid them in favour of natural food products. Third, there is a lack of consistent international food safety regulations, making it difficult for consumers to make informed decisions when buying alternative meat products.

Sustainable and better fish farming

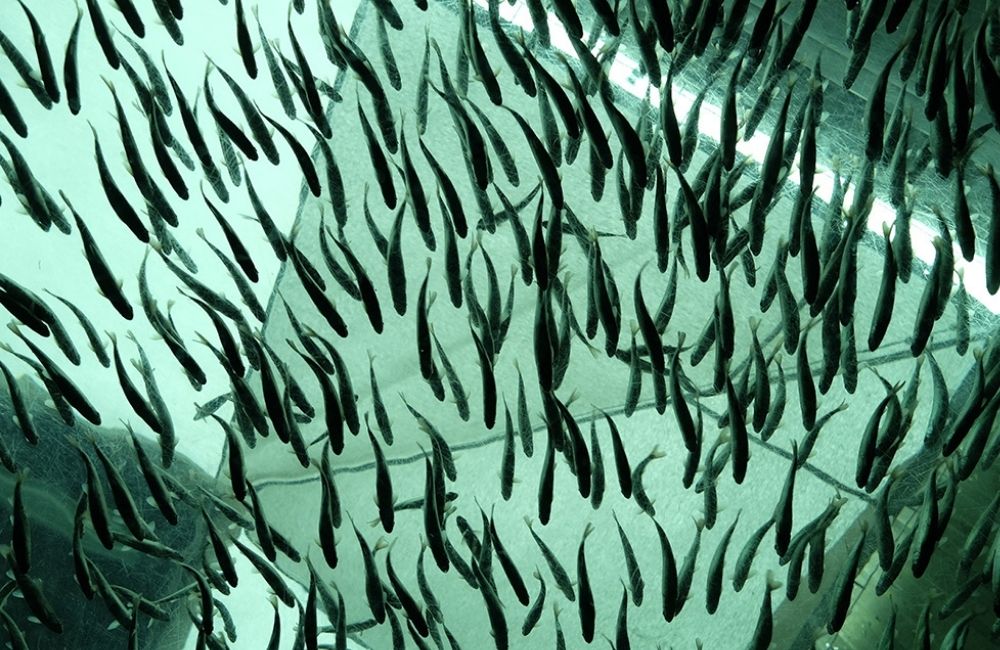

Aquaculture looks set to scale up fish farming sustainably to meet the global demand for seafood.

Aquaculture looks set to scale up fish farming sustainably to meet the global demand for seafood.

While alternative meat sources are a key trend, conventional protein sources like aquaculture are also leveling up their game in the quest to meet the demand for sustainable proteins. Aquaculture refers to the breeding and harvesting of seafood in water environments. With growing demand and overfishing of marine stocks, aquaculture promises to reduce the reliance and impact on wild stock and augment the production of fish protein sustainably.

Today, Asia dominates the global aquaculture production space, with an 89% share in the last two decades. In Singapore, aquaculture production currently makes up 10% of the nation’s total seafood consumption.

Traditionally, aquatic animals are reared in open systems, such as sea cages, which are vulnerable to changes in the open environment. They can be adversely affected by an increase in water temperature, decrease in pH and oxygen levels, harmful algae blooms, or chemical spills.

“For the growth in aquaculture to be sustainable over the long term, it is important to address these challenges as well as other technical challenges on feeds, genetic selection, disease control, efficient use of resources and system productivity,” said Associate Professor Ralph Graichen, Executive Director of the Agritech & Aquaculture Horizontal Technology Programme Office, A*STAR.

Alternative meat and aquaculture in Singapore

With the “30 by 30” goal to produce 30 percent of Singapore’s nutritional needs locally by 2030, Singapore aims to be at the forefront of innovations in alternative meat and aquaculture.

In December 2020, Singapore became the first nation in the world to approve the commercial sale of cultivated chicken nuggets. Through the Singapore Food Story R&D Programme, the government has also invested substantially to build public sector R&D capabilities in programmes such as CRISP Meats (CentRe of Innovation for Sustainable banking and Production of cultivated Meats) to advance cultivated meat technologies.

As for aquaculture, the local company Apollo Aquaculture Group (AAG) has built an eight-storey vertical farming facility that can produce 2,700 tonnes of fish a year. Through recirculating aquaculture systems, AAG’s farm is able to culture multiple species, such as shrimp, grouper and coral trout, with less carbon footprint while maximising land productivity.

Meanwhile, Singapore Aquaculture Technologies (SAT) and Aquaculture Centre of Excellence (ACE) have developed sophisticated floating closed containment systems that have transformed traditional coastal fish farming. Their farms allow for fish rearing in a controlled environment that protects the fish from adverse conditions, recycles water and does not release waste into the ocean. Located off Pasir Ris Coast, SAT’s floating fish farm is even equipped with integrated artificial intelligence and video analytics system to track the health and growth rate of the fish.

With considerable innovative developments in both the alternative meat and aquaculture spaces, the future looks bright for Singapore to play a greater part in the global effort to feed the world sustainably.

A*STAR celebrates International Women's Day

From groundbreaking discoveries to cutting-edge research, our researchers are empowering the next generation of female science, technology, engineering and mathematics (STEM) leaders.

Get inspired by our #WomeninSTEM